Cross-Border Invoice Extractor

Extract invoice data from cross-border transactions automatically. Handle invoices for international trade, imports, exports, and cross-border services.

Drop PDF here or click to upload

What will be extracted

Fields to Extract

15 fields

Tables

1 tables

items

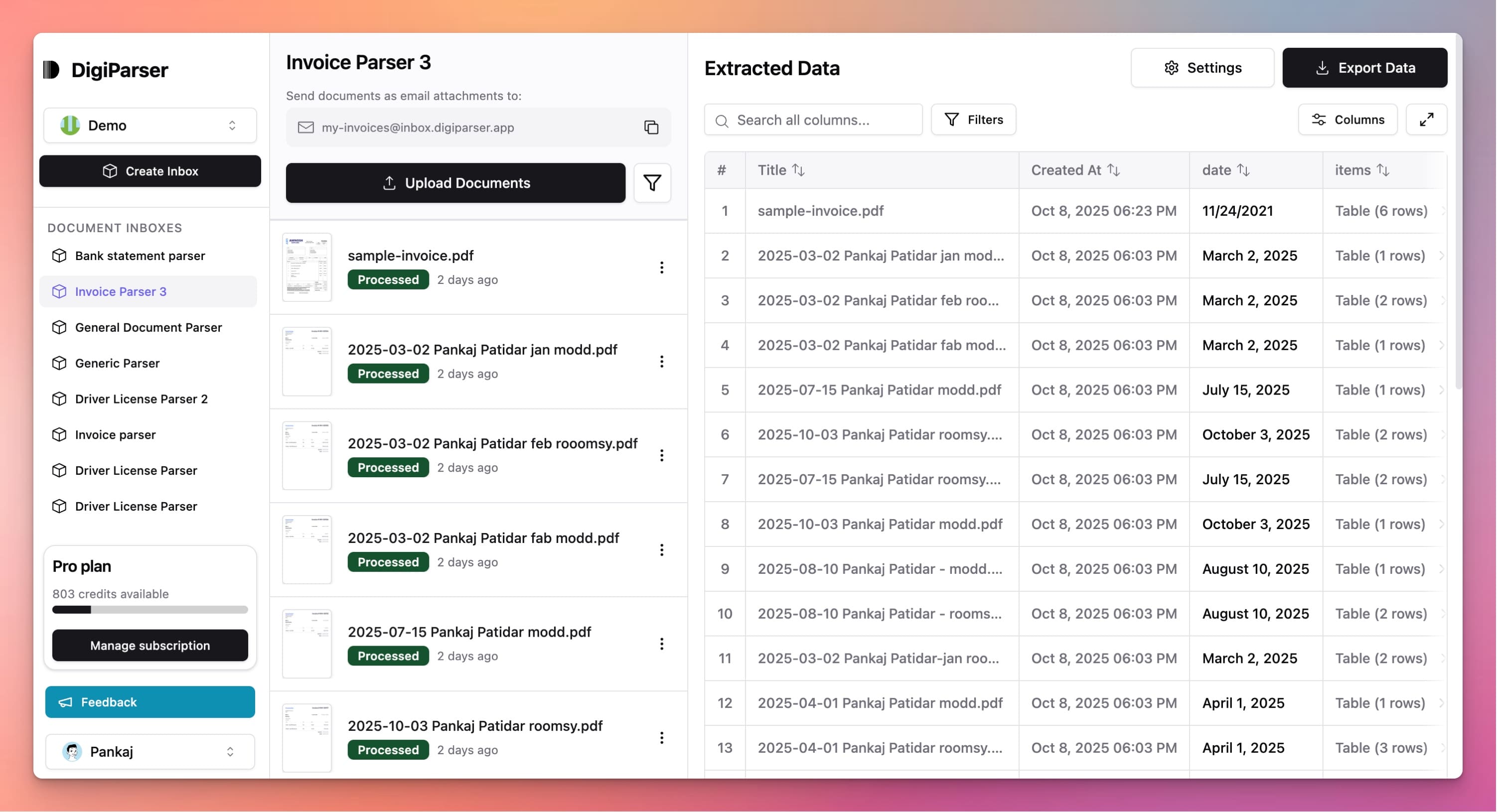

Get Production-Ready Data Extraction

Upgrade to DigiParser — the enterprise-grade data extraction platform capable of handling hundreds of pages with 99.9% accuracy and unlimited advanced use cases.

Extractable Data Fields

This tool extracts the following structured data fields from your documents:

Fields

- currencystring

- Three-letter ISO 4217 currency code in uppercase (e.g., USD, EUR).

- buyer namestring

- Legal name of the party.

- tax amountnumber

- Total tax amount included in the invoice.

- seller namestring

- Legal name of the party.

- buyer vat idstring

- VAT or tax identification number for the party.

- invoice datestring

- Date the invoice was issued, in YYYY-MM-DD format.

- total amountnumber

- The total invoice amount, including taxes.

- buyer addressstring

- Full address including street, city, and postal code.

- seller vat idstring

- VAT or tax identification number for the party.

- invoice numberstring

- The unique invoice identifier.

- seller addressstring

- Full address including street, city, and postal code.

- source countrystring

- Two-letter ISO 3166-1 alpha-2 source country code.

- buyer country codestring

- Two-letter ISO 3166-1 alpha-2 country code.

- destination countrystring

- Two-letter ISO 3166-1 alpha-2 destination country code.

- seller country codestring

- Two-letter ISO 3166-1 alpha-2 country code.

Tables

items

List of individual line items on the invoice.

- quantitynumber

- The total quantity of this item.

- line totalnumber

- Total amount for this line (quantity × unit price, before tax).

- tax amountnumber

- Tax amount for this line item.

- unit pricenumber

- Price per unit (before tax) in the invoice currency.

- descriptionstring

- Description of the item or service.

Features

Extracts cross-border transaction details

Handles import/export invoice formats

Identifies customs and duty information

Captures international shipping details

Processes invoices with multiple jurisdictions

Benefits

Process cross-border invoices efficiently

Handle international trade transactions

Simplify import/export accounting

Reduce errors in cross-border processing

Support global trade operations

Use Cases

Import Invoice Processing

Process invoices for imported goods and services. Extract invoice details including customs information, duties, and international shipping costs.

Export Transaction Management

Handle invoices for exported products. Extract invoice data to track export sales and maintain accurate international trade records.

Cross-Border Service Invoicing

Process invoices for cross-border services. Extract invoice information to handle international service transactions and ensure proper tax treatment.

Frequently Asked Questions

What cross-border scenarios are supported?

The tool works with invoices for imports, exports, cross-border services, and international trade transactions. It handles various cross-border invoice formats.

Can it extract customs and duty information?

Yes, the tool extracts customs duties, import taxes, and other cross-border charges when they appear on invoices. It identifies these components separately.

What about currency conversion for cross-border invoices?

The tool extracts amounts in the currency shown on the invoice. Currency conversion for cross-border transactions would be handled separately using exchange rates.

Upgrade to DigiParser Pro

Process unlimited documents with API access, custom integrations, and enterprise-grade features.

Invoice Parser

Automate accounts payable with AI-powered invoice processing. Extract vendor details, line items, and totals with 99.7% accuracy.

Purchase Order Parser

Streamline procurement with automated PO data extraction.

No credit card required • 20 free documents included