GST Invoice Extractor (India)

Extract GST information from Indian invoices automatically. Get GSTIN numbers, GST amounts, CGST, SGST, and IGST details for GST compliance and filing.

Drop PDF here or click to upload

What will be extracted

Fields to Extract

14 fields

Tables

1 tables

line items

Get Production-Ready Data Extraction

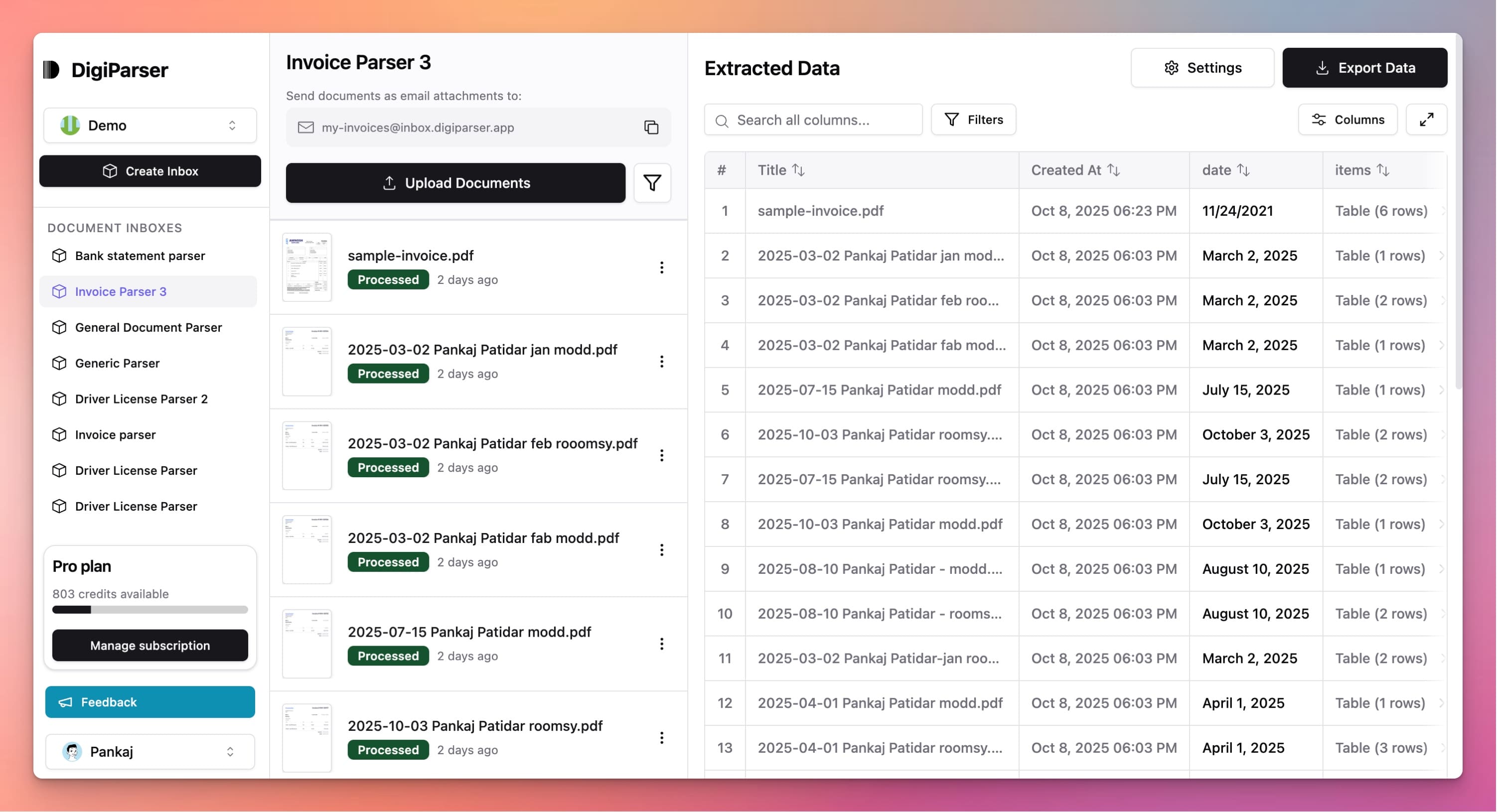

Upgrade to DigiParser — the enterprise-grade data extraction platform capable of handling hundreds of pages with 99.9% accuracy and unlimited advanced use cases.

Extractable Data Fields

This tool extracts the following structured data fields from your documents:

Fields

- buyer namestring

- Legal name of the buyer

- buyer gstinstring

- GSTIN of the buyer (15 characters), may be empty if not provided

- seller namestring

- Legal name of the seller

- invoice datestring

- Invoice date in DD-MM-YYYY format

- seller gstinstring

- GSTIN of the seller (15 characters)

- buyer addressstring

- Address of the buyer as mentioned in the invoice

- invoice valuenumber

- Total invoice value in INR

- invoice numberstring

- Invoice number as per GST invoice

- seller addressstring

- Address of the seller as mentioned in the invoice

- place of supplystring

- Place of supply (State/UT name and code as per invoice)

- taxes cess amountnumber

- Total Cess amount in INR

- taxes cgst amountnumber

- Total CGST amount in INR

- taxes igst amountnumber

- Total IGST amount in INR

- taxes sgst amountnumber

- Total SGST amount in INR

Tables

line items

List of all line items in the invoice

- ratenumber

- Unit rate (price per quantity) in INR

- unitstring

- Unit of measurement (e.g. NOS, KGS, PCS)

- hsn sacstring

- HSN/SAC code as per GST

- gst ratenumber

- Applicable GST rate (%) for this item

- quantitynumber

- Quantity of goods/services

- descriptionstring

- Description of the goods/services

- taxable valuenumber

- Taxable value of this line in INR

Features

Extracts GSTIN (GST Identification Number)

Captures CGST, SGST, and IGST amounts

Identifies GST rates and tax breakdowns

Handles intra-state and inter-state invoices

Extracts HSN/SAC codes for goods and services

Benefits

Prepare GST returns accurately and faster

Meet GST compliance requirements easily

Process Indian supplier invoices efficiently

Reduce GST calculation errors

Simplify GST filing and reporting

Use Cases

GSTR Filing Preparation

Extract GST details from supplier invoices to prepare your GSTR returns. Get all input tax credit information ready for GST portal submission.

Inter-State Invoice Processing

Process invoices from out-of-state suppliers and extract IGST information. Ensure proper GST treatment for inter-state purchases and services.

HSN Code Verification

Extract HSN or SAC codes from invoices to verify correct classification. Ensure suppliers are using appropriate codes for GST compliance.

Frequently Asked Questions

What GST components are extracted?

The tool extracts CGST (Central GST), SGST (State GST), and IGST (Integrated GST) amounts. It also captures GST rates and HSN/SAC codes from invoices.

Does it work with both B2B and B2C invoices?

Yes, the tool works with both business-to-business and business-to-consumer invoices. It extracts GST information regardless of invoice type.

Can I use this for input tax credit claims?

The extracted GST data includes all information needed for input tax credit claims. You can use the data to prepare your GSTR-2 and GSTR-3B returns.

Upgrade to DigiParser Pro

Process unlimited documents with API access, custom integrations, and enterprise-grade features.

No credit card required • 20 free documents included