Reverse Charge Invoice Extractor

Extract information from reverse charge invoices automatically. Identify reverse charge transactions and extract relevant details for VAT/GST compliance.

Drop PDF here or click to upload

What will be extracted

Fields to Extract

15 fields

Tables

1 tables

invoice lines

Get Production-Ready Data Extraction

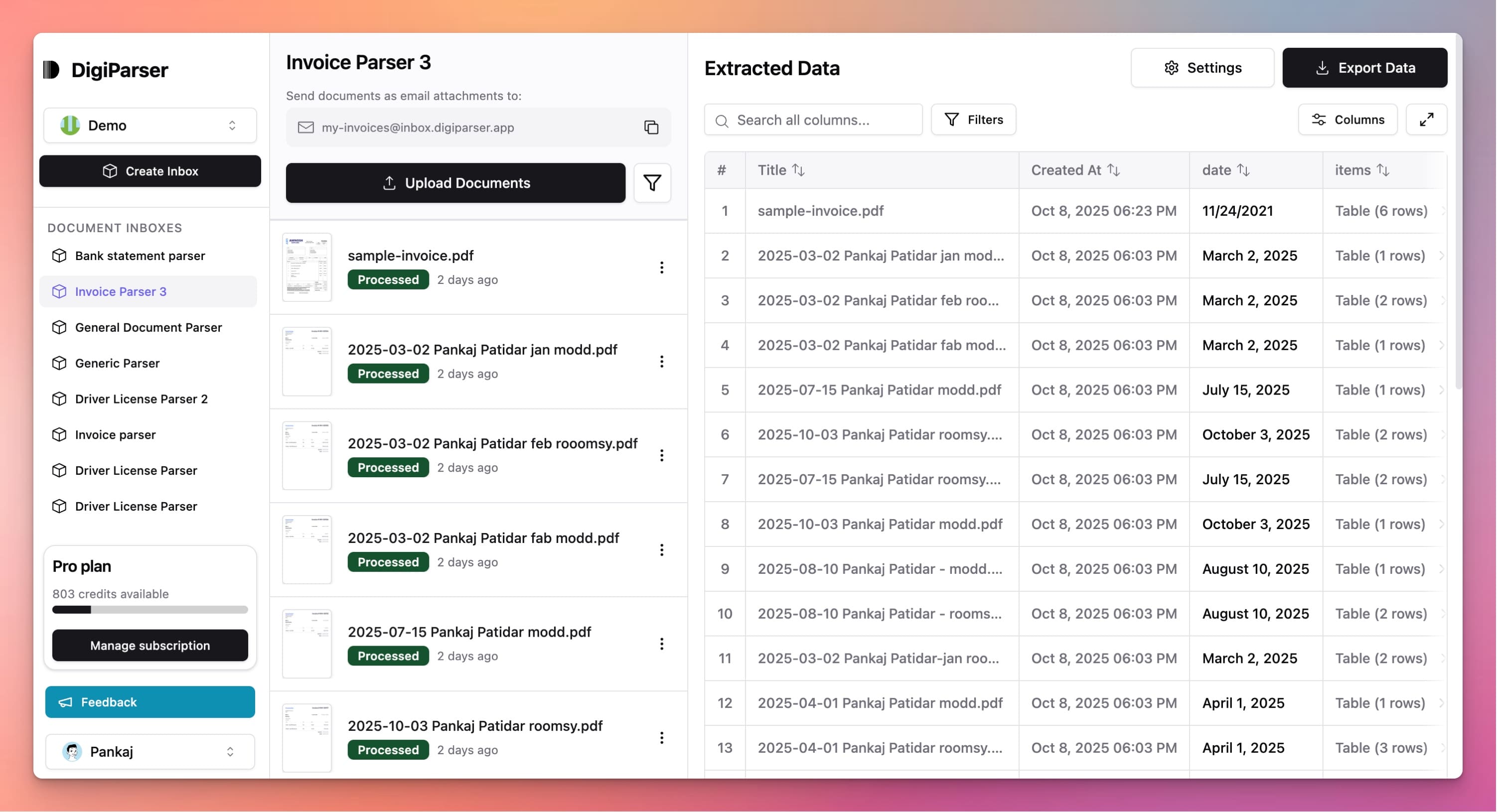

Upgrade to DigiParser — the enterprise-grade data extraction platform capable of handling hundreds of pages with 99.9% accuracy and unlimited advanced use cases.

Extractable Data Fields

This tool extracts the following structured data fields from your documents:

Fields

- currencystring

- ISO 4217 currency code (e.g., EUR, GBP, USD).

- vat ratenumber

- VAT rate (%) that would normally apply.

- invoice datestring

- Date when invoice was issued

- customer namestring

- Customer legal/business name.

- supplier namestring

- Supplier legal/business name.

- invoice numberstring

- Unique reference number for the invoice.

- customer addressstring

- Customer full address.

- customer countrystring

- Customer country name (full or 2-letter ISO code).

- supplier addressstring

- Supplier full address.

- supplier countrystring

- Supplier country name (full or 2-letter ISO code).

- total net amountnumber

- Total net amount for all lines (excluding VAT).

- customer vat numberstring

- Customer VAT registration number.

- supplier vat numberstring

- Supplier VAT registration number.

- reverse charge appliedboolean

- Whether the reverse charge mechanism is applied for this invoice.

- reverse charge referencestring

- Text reference on the invoice specifying the application of the reverse charge.

Tables

invoice lines

Individual goods/services lines for the reverse charge transaction.

- amountnumber

- Line net amount (quantity × unit price).

- quantitynumber

- Quantity of the item/service.

- unit pricenumber

- Unit price (excluding VAT, in invoice currency).

- descriptionstring

- Description of the item or service.

Features

Identifies reverse charge transactions

Extracts reverse charge indicators and notes

Captures invoice details for self-assessment

Handles reverse charge VAT and GST invoices

Separates reverse charge from regular charges

Benefits

Process reverse charge invoices correctly

Ensure proper tax treatment for reverse charge

Prepare accurate reverse charge returns

Reduce errors in reverse charge accounting

Simplify reverse charge compliance

Use Cases

Reverse Charge VAT Processing

Process invoices subject to reverse charge VAT. Extract invoice details to calculate and account for reverse charge VAT on your VAT returns.

Reverse Charge GST Handling

Handle invoices with reverse charge GST. Extract information needed to account for reverse charge GST and claim input tax credit correctly.

Cross-Border Service Invoices

Process invoices for cross-border services subject to reverse charge. Extract details to ensure proper tax treatment and compliance.

Frequently Asked Questions

What is reverse charge and why is it important?

Reverse charge means the buyer accounts for the tax instead of the supplier. This tool helps identify and process such invoices correctly for tax compliance.

Which countries support reverse charge?

Reverse charge applies in various countries including EU member states, India (for GST), and others. The tool works with reverse charge invoices from any jurisdiction.

How do I know if an invoice has reverse charge?

The tool identifies reverse charge indicators on invoices, such as "Reverse Charge" labels, special notes, or specific invoice formats used for reverse charge transactions.

Upgrade to DigiParser Pro

Process unlimited documents with API access, custom integrations, and enterprise-grade features.

No credit card required • 20 free documents included