VAT Invoice Extractor (EU)

Extract VAT information from European Union invoices automatically. Get VAT numbers, VAT amounts, and tax breakdowns for EU compliance and reporting.

Drop PDF here or click to upload

What will be extracted

Fields to Extract

12 fields

Tables

1 tables

items

Get Production-Ready Data Extraction

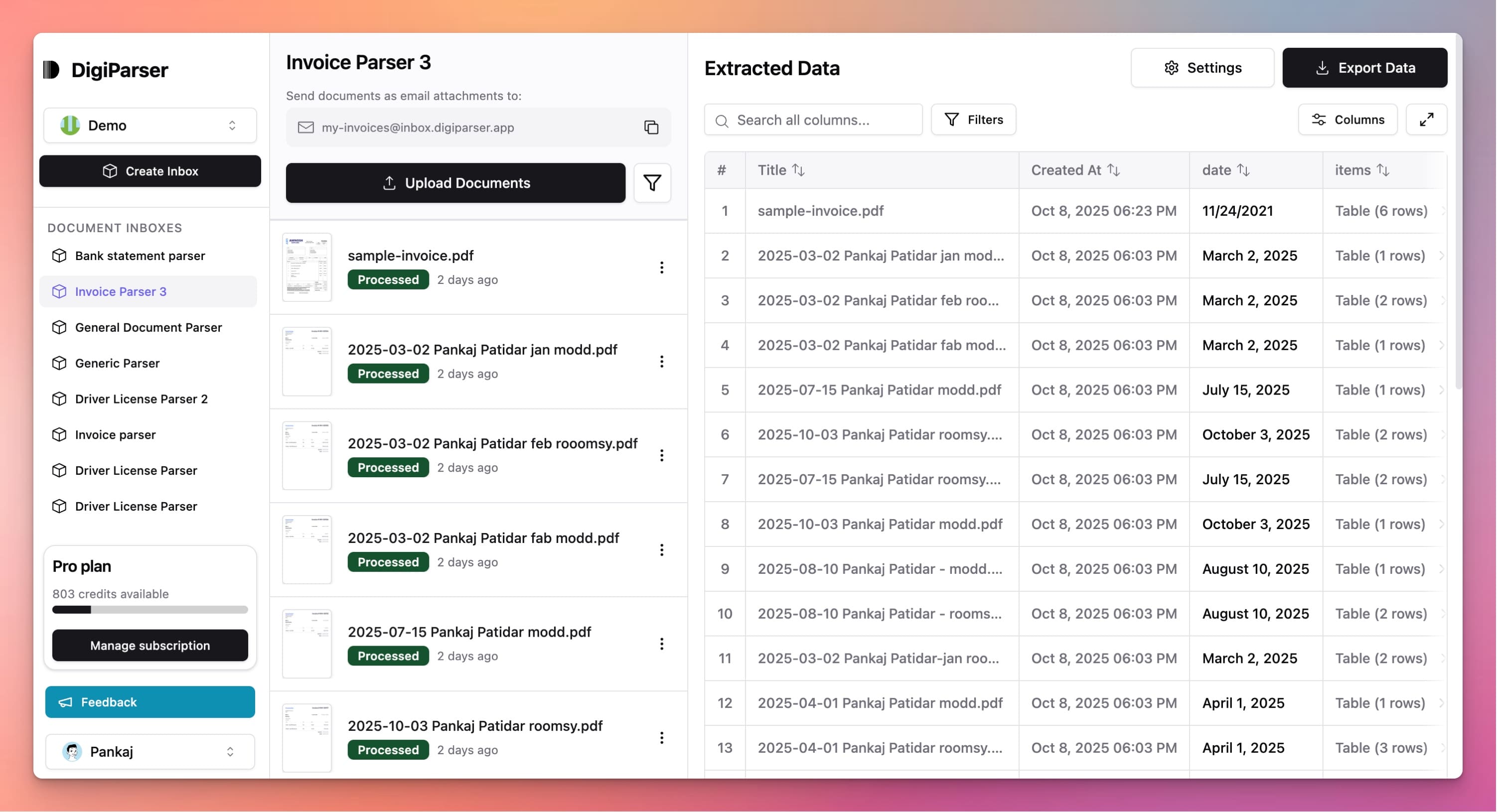

Upgrade to DigiParser — the enterprise-grade data extraction platform capable of handling hundreds of pages with 99.9% accuracy and unlimited advanced use cases.

Extractable Data Fields

This tool extracts the following structured data fields from your documents:

Fields

- currencystring

- Three-letter ISO 4217 code for currency

- total netnumber

- Total invoice amount before VAT

- total vatnumber

- Total VAT amount for invoice

- issue datestring

- Issue date of the invoice in ISO 8601 format (YYYY-MM-DD)

- total grossnumber

- Total invoice amount including VAT

- customer namestring

- Customer's legal company name

- supplier namestring

- Supplier's legal company name

- invoice numberstring

- Invoice identifier as stated on document

- customer vat idstring

- Customer's VAT identifier (country code + number), or empty if not applicable

- supplier vat idstring

- Supplier's VAT identifier (country code + number)

- customer addressstring

- Customer's full postal address

- supplier addressstring

- Supplier's full postal address

Tables

items

List of line items on invoice

- quantitynumber

- Number of units/services billed

- vat ratenumber

- VAT rate (%) applied to this item

- unit pricenumber

- Gross or net unit price

- descriptionstring

- Item description

- total amountnumber

- Total gross or net for this line (depends on invoice type)

Features

Extracts EU VAT registration numbers

Captures VAT amounts and tax rates

Identifies VAT-exempt and zero-rated items

Separates net, VAT, and gross amounts

Handles multiple VAT rates on single invoice

Benefits

Ensure EU VAT compliance automatically

Prepare accurate VAT returns faster

Reduce errors in VAT calculations

Meet EU tax reporting requirements

Simplify cross-border invoice processing

Use Cases

EU VAT Return Preparation

Extract VAT details from EU supplier invoices to prepare your VAT returns. Get all VAT amounts and rates ready for submission to tax authorities.

Cross-Border Invoice Processing

Process invoices from EU suppliers and extract VAT information for proper tax treatment. Ensure correct VAT handling for intra-EU transactions.

VAT Compliance Auditing

Review invoices for VAT compliance. Extract VAT numbers and amounts to verify suppliers are correctly registered and charging appropriate VAT rates.

Frequently Asked Questions

Which EU countries are supported?

The tool works with invoices from all European Union member countries. It recognizes EU VAT registration number formats and standard VAT rates across the EU.

Can it handle reverse charge VAT?

The tool extracts VAT information from invoices. For reverse charge scenarios, you may want to use our Reverse Charge Invoice Extractor tool specifically designed for that purpose.

What VAT rates are recognized?

The tool recognizes standard VAT rates, reduced rates, and zero rates commonly used across EU countries. It extracts the actual VAT rate shown on each invoice.

Upgrade to DigiParser Pro

Process unlimited documents with API access, custom integrations, and enterprise-grade features.

No credit card required • 20 free documents included